The majority of pitches still skip this crucial question: why now? I often get the feeling that entrepreneurs focus only on the novelty of what they’re doing as if just being “new” makes something worthwhile. Asking “why now” is an antidote to this thinking. Don’t assume you aren’t too early or too late because you might be.

When I do see the “why now” addressed, it’s usually very shallow. Saying the world population is growing is true but does not just mean lots of new consumers for your product. I think most founders get confused about how to answer this question or even where to look for meaningful changes that make their product both inevitable and exciting.

This post will give you some tools and examples to find those important changes in your business environment that will justify why right now is the ideal time to build (and invest in) your company.

Subscribe for free to receive weekly posts, a copy of my ebook Pitching a Leap of Faith, and invitations to my weekly Pitch Masterclass.

Key points I cover:

- Something is always changing, the importance of “Why Now?”

- Frameworks for scanning your business environment.

- A simple tool for answering “Why Now?”

- 3 examples: YouTube, Clearbanc, LinkedIn

- Putting it all together

Something is always changing.

Markets are not static. If they were, there would be no disruption and no startups. The Why Now slide is your chance to explain what is changing. Here are some examples:

- In North America, people are living longer and having fewer children later in life

- AI now makes it possible to write blog posts better than most bloggers (a fairly low bar)

- Remote work has gone from fringe practice to the default

- Increasingly strict regulations around climate change are making some products obsolete, like single-use plastic straws

The point is, there is always some change driving the need for your product. It could be an unsatisfied need in the market or a scientific breakthrough. But it’s something real.

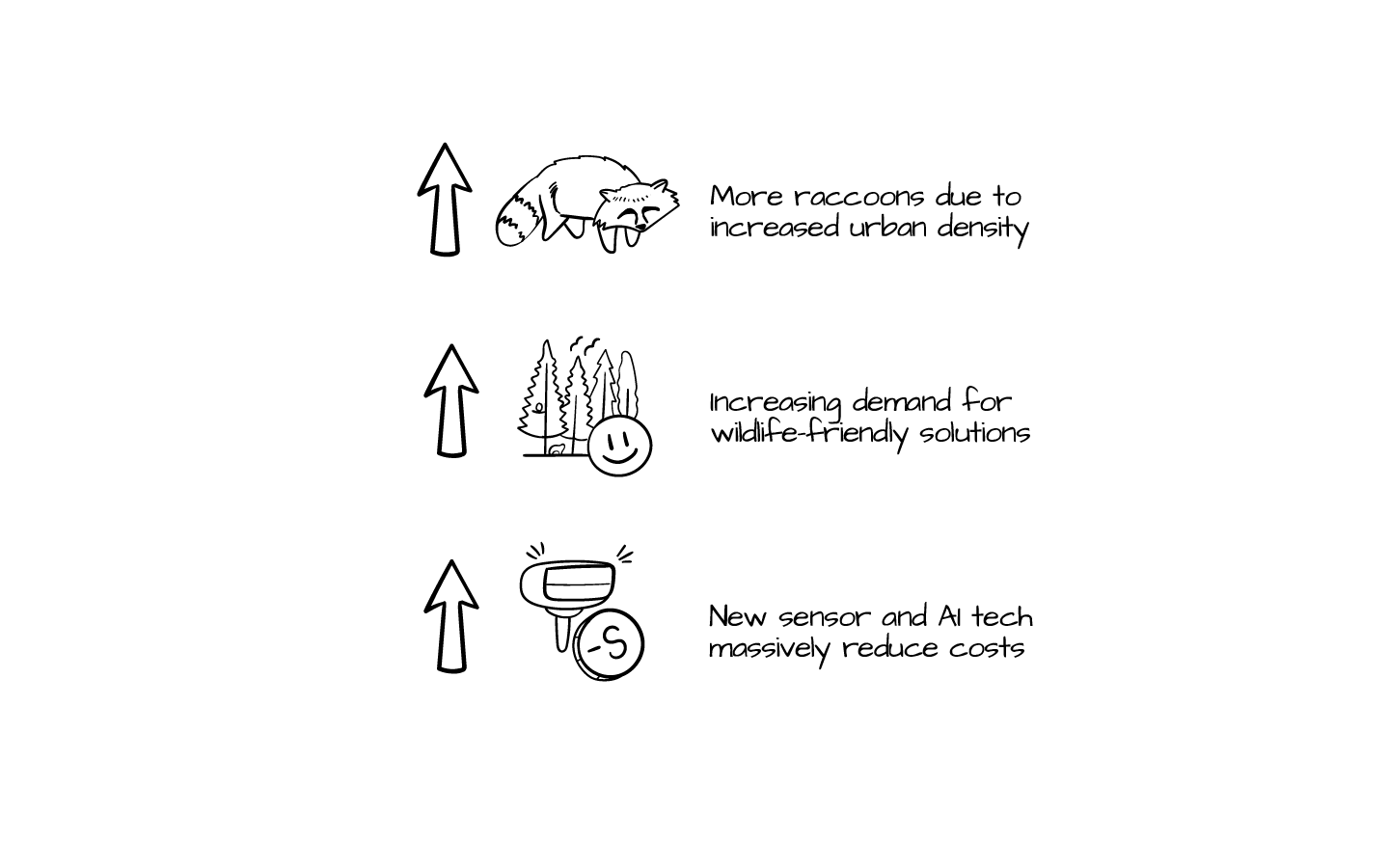

Here’s a simple example, literally from my backyard:

This is the Why Now slide for a non-lethal anti-wildlife sprinkler (which I own).

- There is a change in demand for this product (more raccoons).

- Other solutions are no longer working (because people no longer want to hurt the animals, for some reason).

- Technological changes that make this product possible (AI raccoon recognition algorithms, wishful thinking, contact me if you’ve built it).

These points explain the context of this startup, why it couldn’t exist before, and why there is an opportunity to take advantage of this market right now.

By the way, it’s not important whether you have a standalone Why Now slide or you add content to your problem, solution, market or even competition slides.

Some frameworks for scanning your environment.

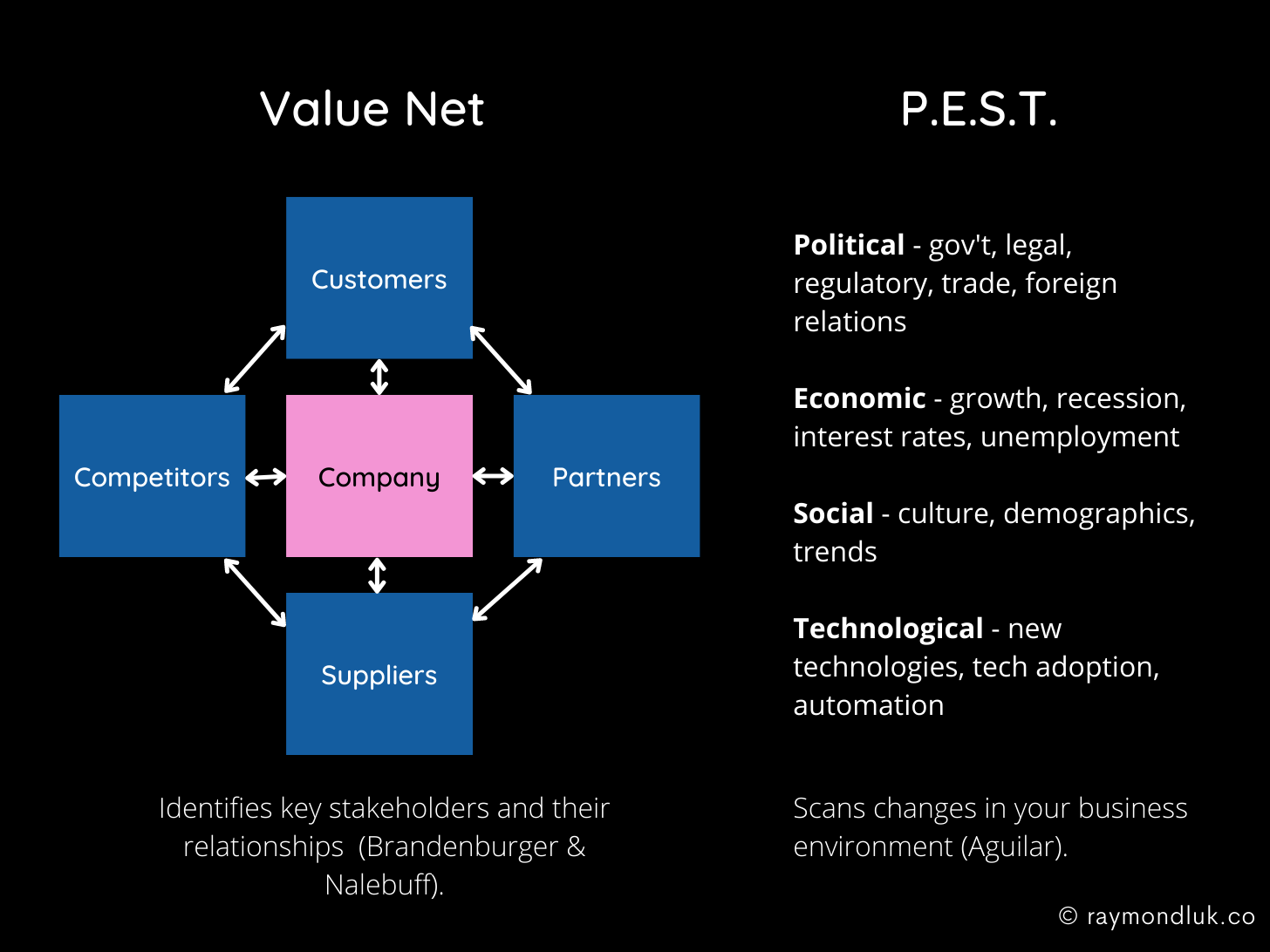

If you are struggling to figure out how to identify changes in your environment, these two strategy frameworks are a good place to start: PEST and the Value Net. You will probably also find these useful for strategic planning, but I am only focusing on using them to help your storytelling.

Value Net (from the book Co-opetition by Brandenburger and Nalebuff) is a way to map out the key players (suppliers, partners, customers, competitors) that your company interacts with. It shows not only how you interact with them, but how they interact with each other. This is a very useful way to look for changes by considering who is affected by change.

Most startup pitches focus on changes in customer behaviour. But change can occur in other places, e.g. your suppliers. Changes to their cost structure or their technology adoption can have a huge impact on your market and product.

PEST is another framework that helps you scan for important macro-environmental changes. Its four categories (political, economic, social, technological) describe broad changes that can make it easier, or more difficult, for businesses to operate. Some versions of PEST add environment and legal (PESTEL) but I’m keeping it simple for our purposes.

For most startups it’s easy to focus on technological changes. But if you were a privacy tech startup, for example, how the regulatory environment changes (e.g. stricter digital privacy laws) might be the most important part of your story.

An easy tool for analyzing your Why Now.

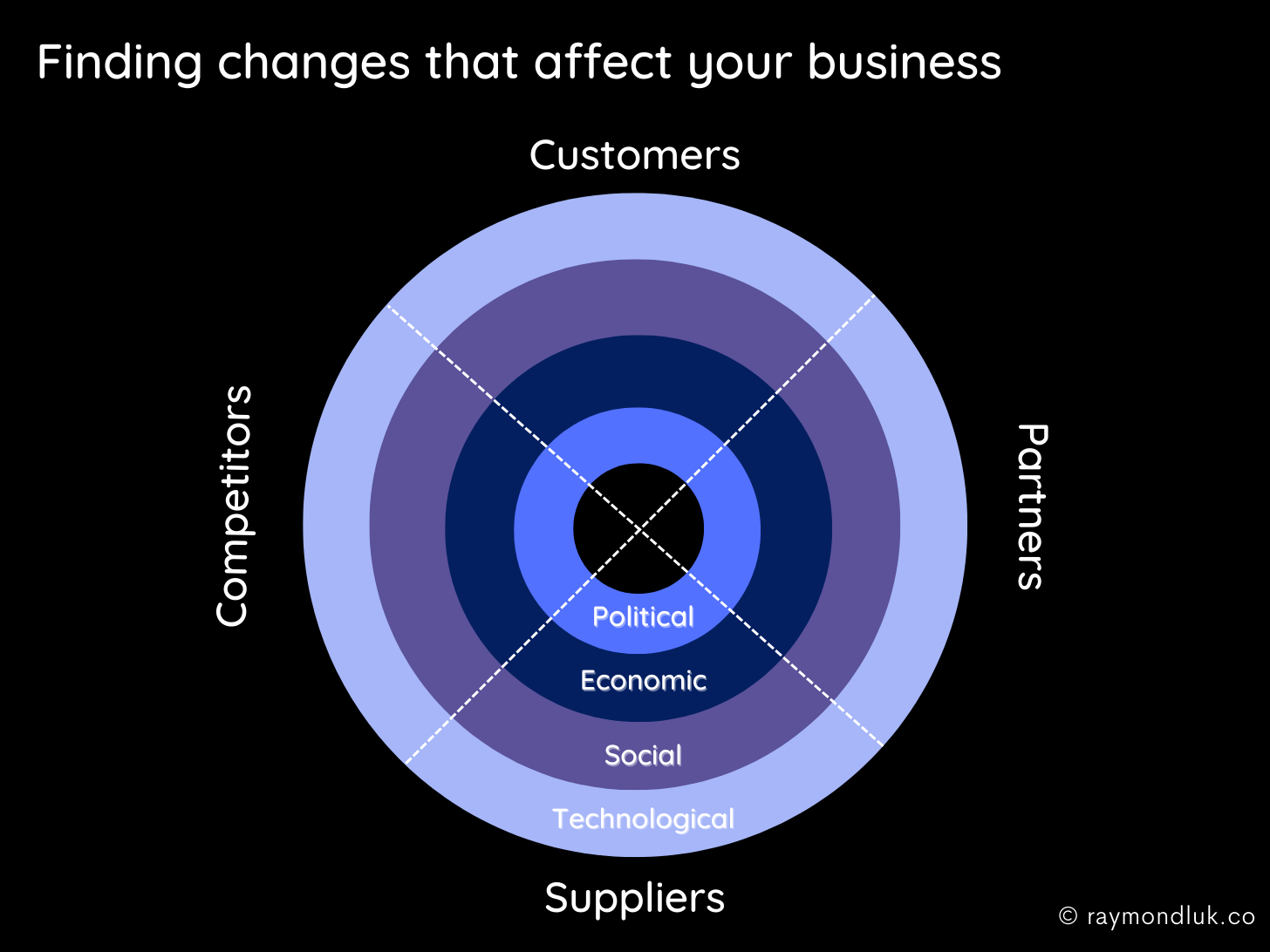

I combined Value Net and PEST into a simple tool that founders can use to quickly identify business environment changes they can use in their Why Now slides.

Each coloured ring represents one factor you should consider. Then I’ve divided everything into 4 slices based on the types of players those changes affect.

Using it is simple: for each stakeholder type ask yourself if they’re affected by any of the four factors. E.g., are your customers changing their buying habits due to political issues (like a war), or economics (a recession), social factors (aging population) or technological (AI).

The goal is not to have the most changes! For your pitch deck there are probably only 2-3 major changes you’ll want to take about. This tool will help you identify the changes that matter to your story.

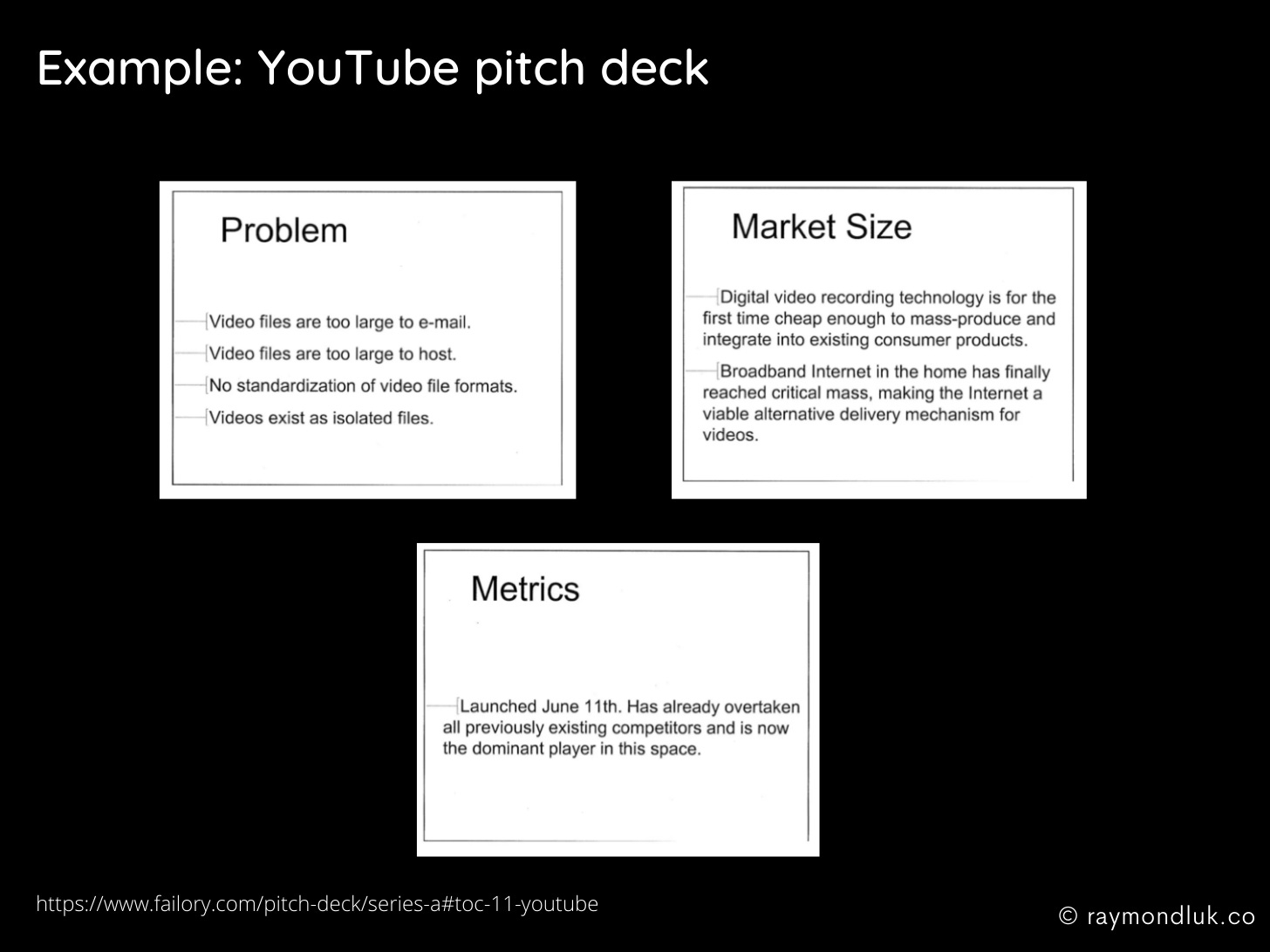

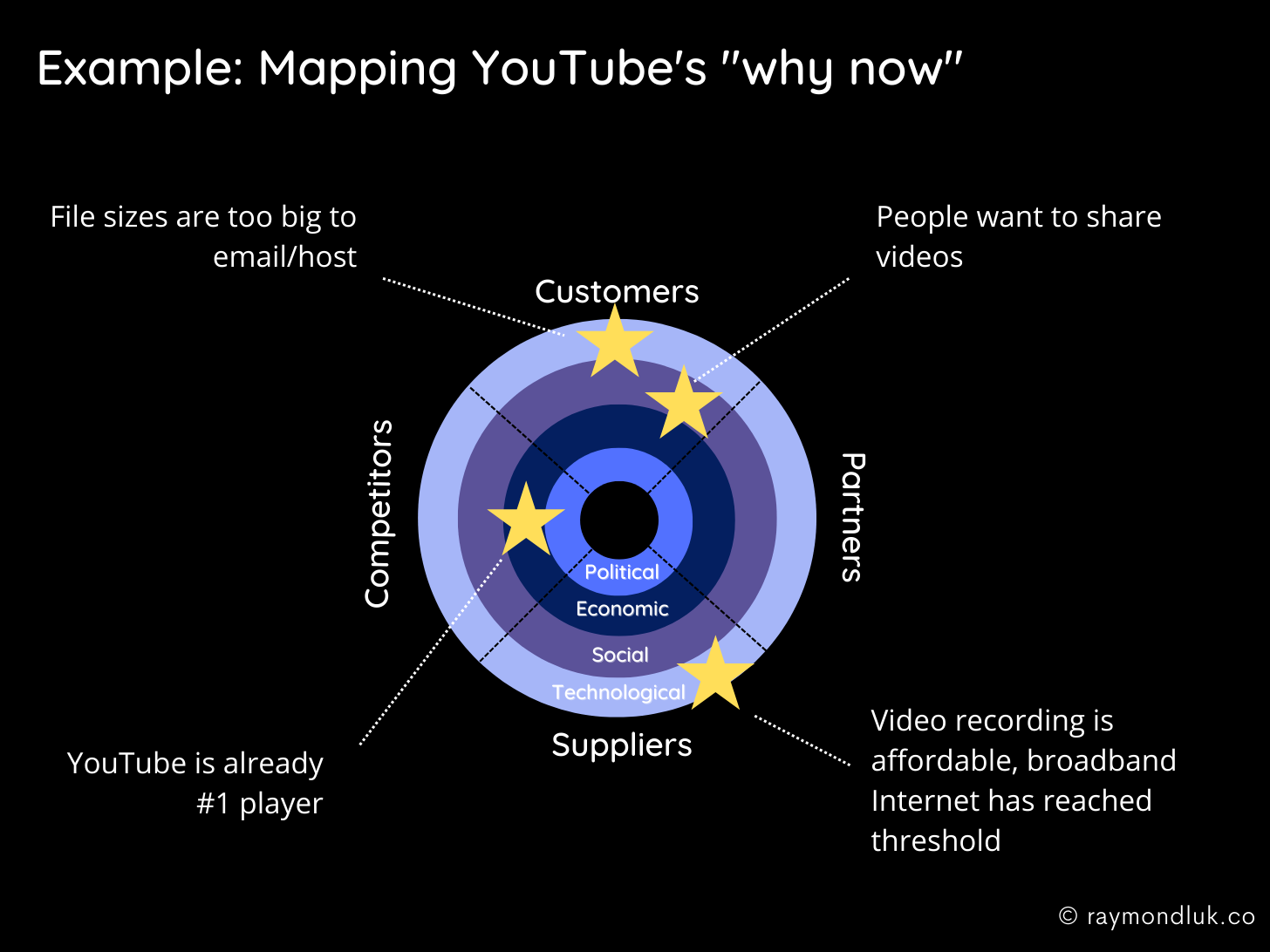

Example 1: YouTube

This is from YouTube’s early pitch deck:

At the time they made their pitch deck, YouTube was saying two things about users of video: they wanted to share videos (a fairly new social phenomenon) but file sizes were too big (a technological limitation that didn’t exist before cheap digital video technology created big digital video files).

The decreasing cost of digital video equipment plus broadband Internet access becoming widespread were both changes that made YouTube possible.

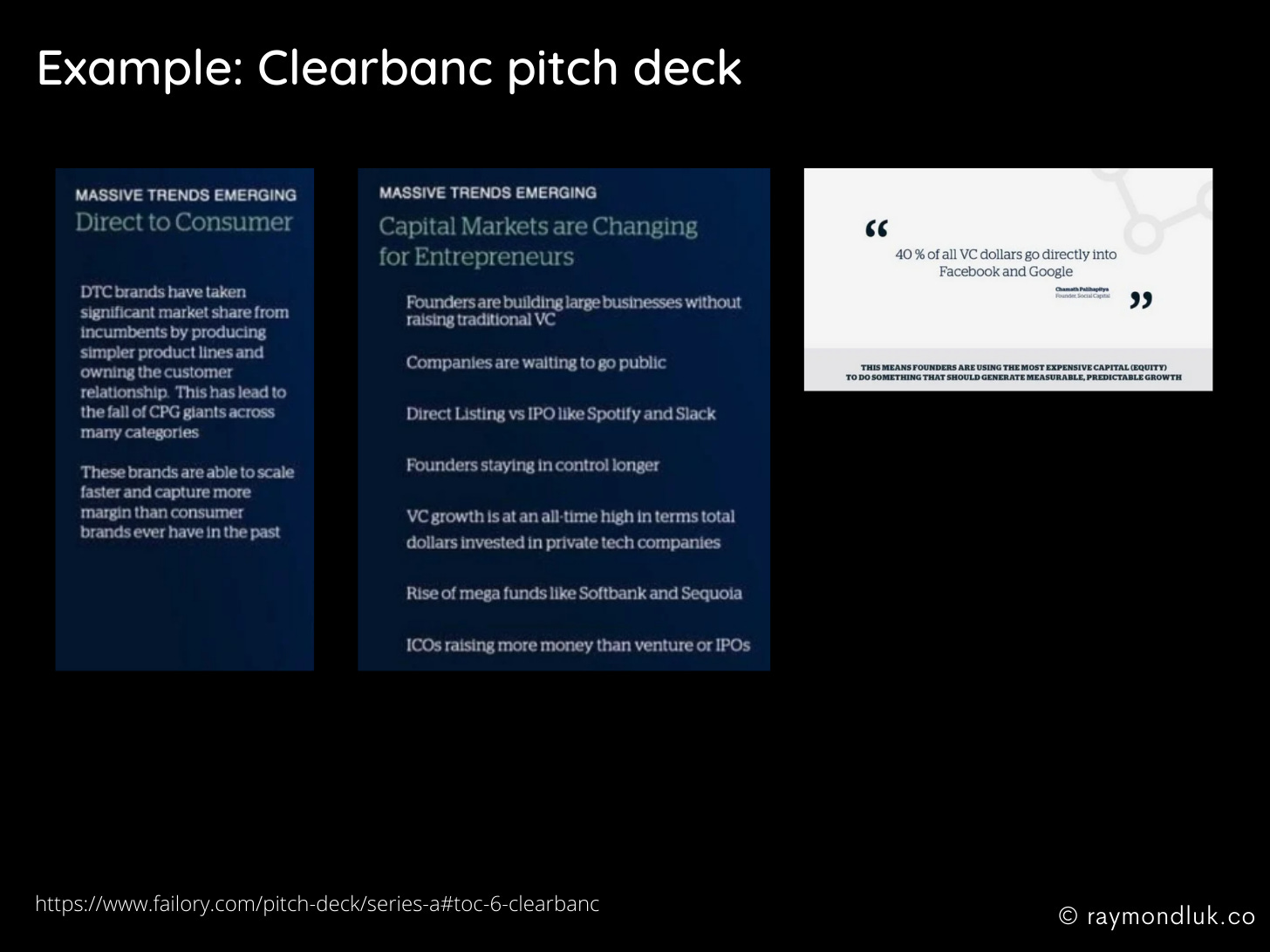

Example 2: Clearbanc

This is an early deck (back when Clearco was called Clearbanc).

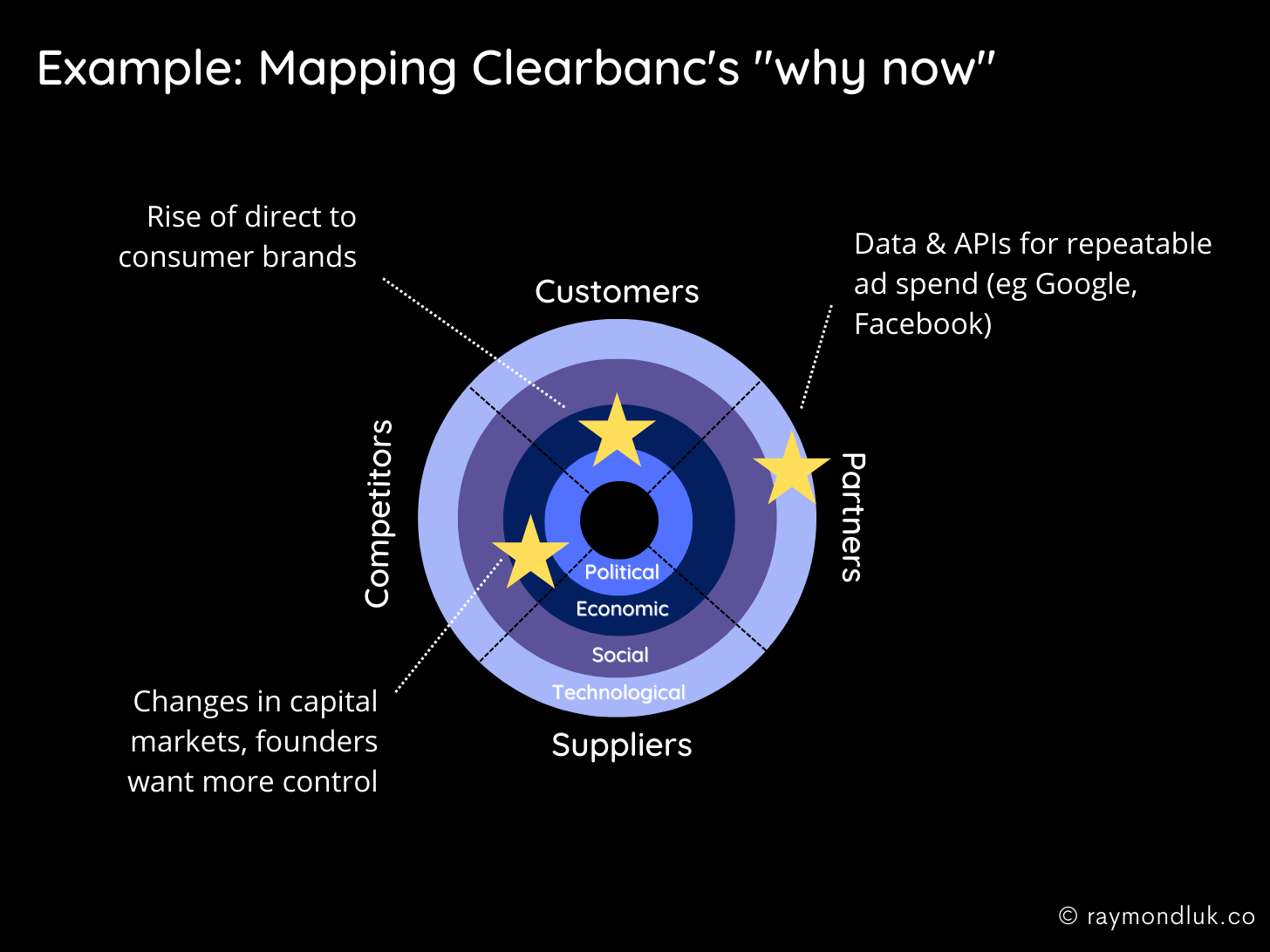

Reverse-engineering their “why now,” Clearbanc has identified three main market changes.

- There is a change in consumer behaviour (the rise of DTC brands) that affects Clearbanc’s customers (the DTC brands).

- There are changes in capital markets, include longer periods of time to IPO, more VC funding, but no change in the relatively high cost of both debt and equity. In other words, there’s higher demand for capital from DTC brands but no change to the supply of capital. Enter Clearbanc.

- The last change that enables Clearbanc’s product is the availability of data and APIs from ad networks like Google and Facebook. This allows Clearbanc to use that data, plus payment platforms like Stripe, to tech-enable underwriting, funding and repayment via royalties.

Example 3: A Startup vs LinkedIn

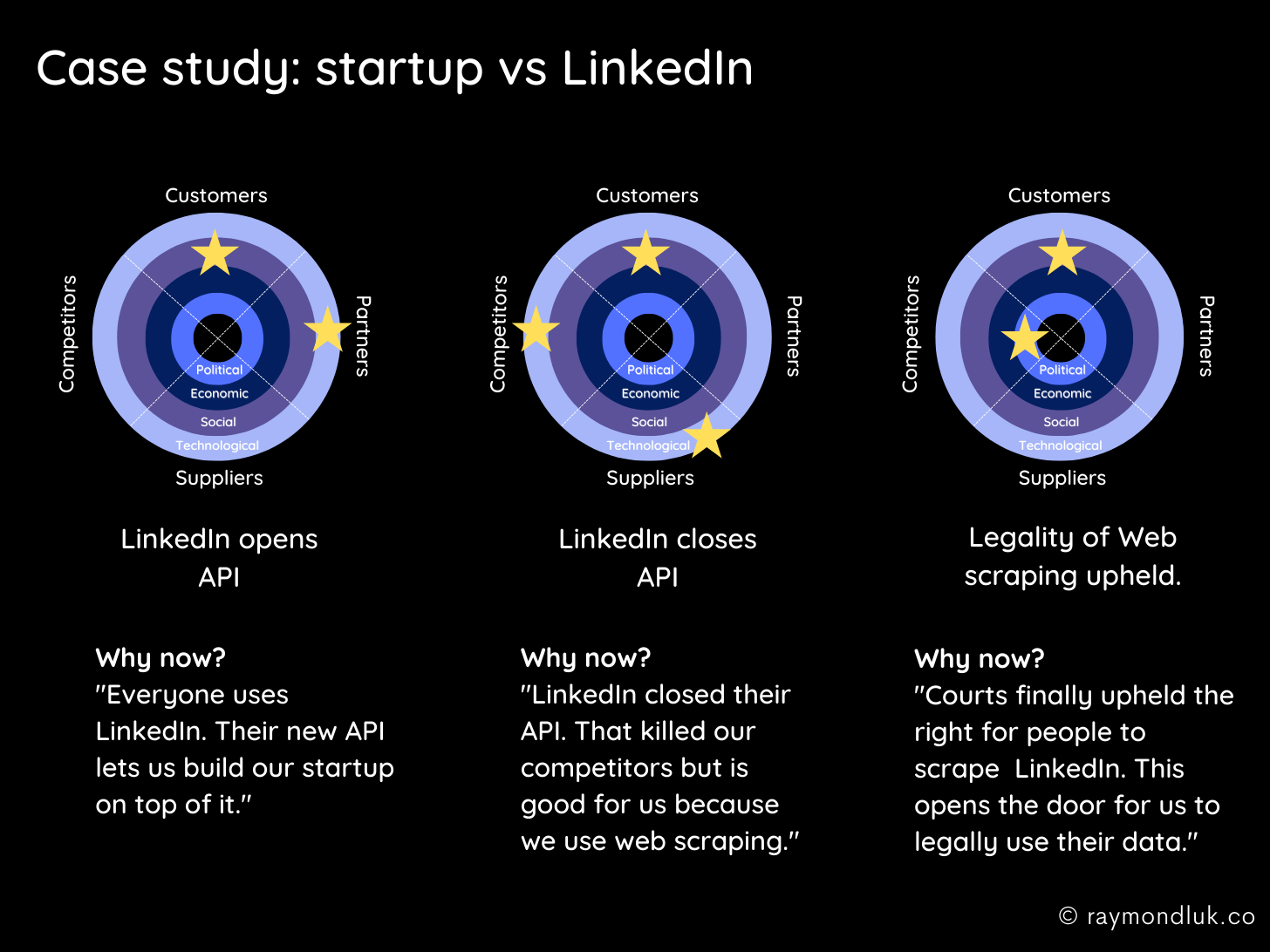

This next example is of a fictional startup at three moments in time: when LinkedIn opened its API, when it closed it, and when courts decided LinkedIn could not stop Web scraping.

As you can see, there are different types of environmental changes in all three cases representing both opportunities and threats to a startup building on top of LinkedIn (with or without permission).

In the first scenario, the startup’s “why now” is primarily the availability of LinkedIn’s API which enables new types of apps to be built on top of it.

Imagine that same startup fundraising in scenario two. Now LinkedIn is no longer a partner, it is arguably a competitor. But the startup’s investment in Web scraping makes it a better investment vs competitors who did not.

In the third scenario there is no change to technology but a political change: a court recently ruled that LinkedIn could not stop companies from scraping its public data. This change could set the stage for the startup to do even more scraping of LinkedIn data, enabling new product features, without fear of litigation.

Thinking about how environmental factors change and affect a company is not only good strategic planning but focuses investors on why the world needs your product at this moment in time.

Putting it all together.

Spend some time analyzing other companies and how they explain why now is the ideal time to build their business. It won’t always be explicit but the Value Net + PEST tool will help you reverse-engineer those assumptions.

The goal is for you to develop this skill for your own company so your pitch always includes a sense of urgency.

Pitches, and companies, are built on opportunities that exist at a moment in time. Describe this moment, your moment, in terms of what is changing.