They said you were too early, but they’re a pre-seed fund.

You don’t fit their fund thesis, but you know they invested in your space.

They told you they love what you do but you need to go faster and spend more money (then they passed).

You pitched 10 investors and each gave you different advice.

It’s no wonder founders are totally confused after they pitch. Books could be written about VC feedback.

Subscribe for free to receive weekly posts, a copy of my ebook Pitching a Leap of Faith, and invitations to my weekly Pitch Masterclass.

It’s Not You, It’s Them.

Hypothetically, let’s say VCs are naturally confusing people (hypothetically). It’s what made them become VCs and not insurance adjusters. Totally not your fault.

VCs are not in the feedback business.

Investors are in the business of saying ‘no’ almost always, and ‘yes’ a (very) few times. A VC might hear 400 or more pitches in a year. They say yes 4 times and no 396 times. No matter how generous they are with their time and feedback they are paid to say yes the right 4 times.

Recognize when you’re getting a NO.

Put yourself in the VC’s shoes. You’ve just heard a pitch and you’ve decided to pass. Do you see yourself saying any of the following?

“I just don’t like you.”

“Everything about you ticks all the right boxes but I just can’t explain why I don’t want to invest.”

“We’re passing but I’m still going to write you a 5-page analysis of exactly why…”

Nope. Which means you probably have unrealistic expectations of what a VC owes you. If you aren’t getting a yes you’re probably getting advice. Extract all the value you can but recognize it’s a no and move on.

It’s Not Them, It’s You.

Founders hate rejection.

Show me someone who loves rejection and that’s not someone I want to invest in. The pain of rejection is a natural human emotion. The reality is a lot of your ‘confusion’ is mixed up with not enjoying getting rejected.

You’re looking for validation.

So many founders get excited when a name-brand VC likes their business and get crushed when they get negative feedback. This is validation-raising, not fundraising. Investors want you to validate your business, not the other way around.

You aren’t a fit for the VC model.

You lay out a plan for building a big, profitable business but VCs keep telling you the market is too small. Or you have traction but investors pick on the fact you haven’t shown how you can acquire users at scale. These disconnects are often about business-funding fit (BFF). I.e. you have a great business and you deserve to get funding, but not necessarily VC funding. The best thing you can do is to learn about how the venture model works and how they make money. There are plenty of great blog posts covering that topic. That helps to remove any value judgement about whether you’re “good enough” for VC.

Have your own opinion.

If you listen carefully and are open-minded, you’ll learn a ton from VCs when they give you feedback. But you should still have your own (strong) opinion. Instead of looking for feedback to validate what you’ve done, recognize that VCs are investing in you because they believe you are the best person to realize this opportunity.

Chase the lovers.

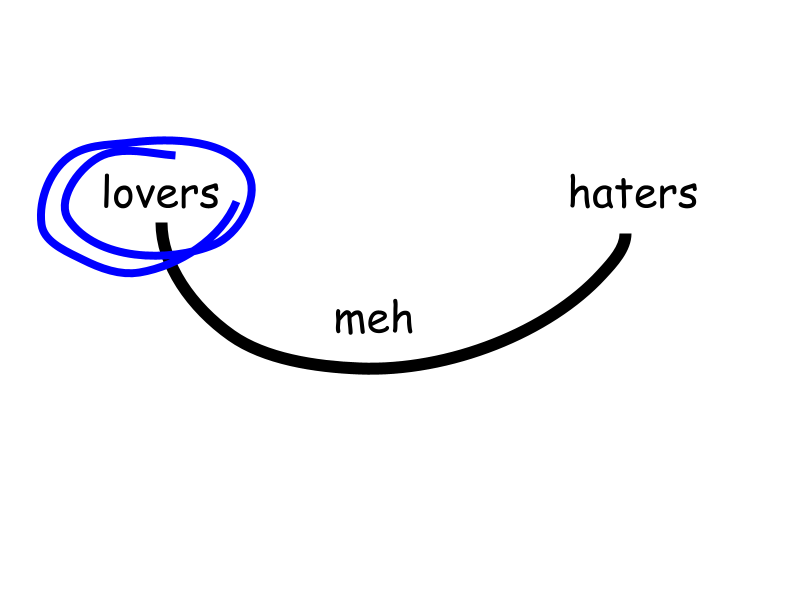

The following beautifully-designed diagram explains where you should spend your time and energy when you’re fundraising:

When you’re pitching, you’re looking for the lovers. Ignore the haters (it’ll be easy because they hate you). The biggest pitfall is spending too much time trying to convert the people who are in between. They don’t hate you enough to say NO and they don’t love you enough to give you an immediate YES.

The “trough of meh” is where you’ll get the most feedback. Keep listening and learning, but keep your eye on chasing the lovers. If you don’t see an investor ever falling in love with your startup, break up and move on.

Subscribe for free to receive weekly posts, a copy of my ebook Pitching a Leap of Faith, and invitations to my weekly Pitch Masterclass.