This is part 7 of a series that walks through the slides in a pitch deck. See Start With the Problem, and Your Startup’s DNA: The Solution Slide, How Not to Waste Your Product Slide, Why Now: Change is the Key to your Pitch, The Market Size Dilemma, and How Not to Lie To Yourself About Competition.

If your value proposition is how you create value for customers (and differentiate yourself from competitors), your business model shows how you turn that into profit in the long run. Unfortunately, most pitches don’t talk about how the business actually makes money, which is obviously a problem for an investor.

The top three mistakes are:

- Not mentioning the business model

- Only using a pricing slide

- Not being specific enough

Many pitch decks do not include a separate slide for the business model. It’s possible to piece together the story from different slides but it’s not as effective.

A lot of entrepreneurs think that a pricing slide is the same as a business model. It’s not because it doesn’t show how you can charge that price and make a profit.

Even pitch decks with a decent business model slide often do not have any numbers on them. There’s no point having a slide that only talks about the “high level” business model. Nothing turns off an investor more than hearing someone gloss over numbers. Remember that what they’re investing in is your business model, not your product.

As with all of the posts in this series, I’m focusing on how to tell the story of your business model, not how to design it. You can learn about that in Alexander Osterwalder’s Business Model Canvas.

Key points I cover:

Breaking down how you make money

Business model examples

An idealized business model: the flywheel

What can go wrong?

Breaking down how you make money

It’s easy to overcomplicate things when you show your business model. You should remember that having an innovative startup does not necessarily mean you have to have a crazy new business model. Sometimes being too inventive shows that you don’t know how your industry works.

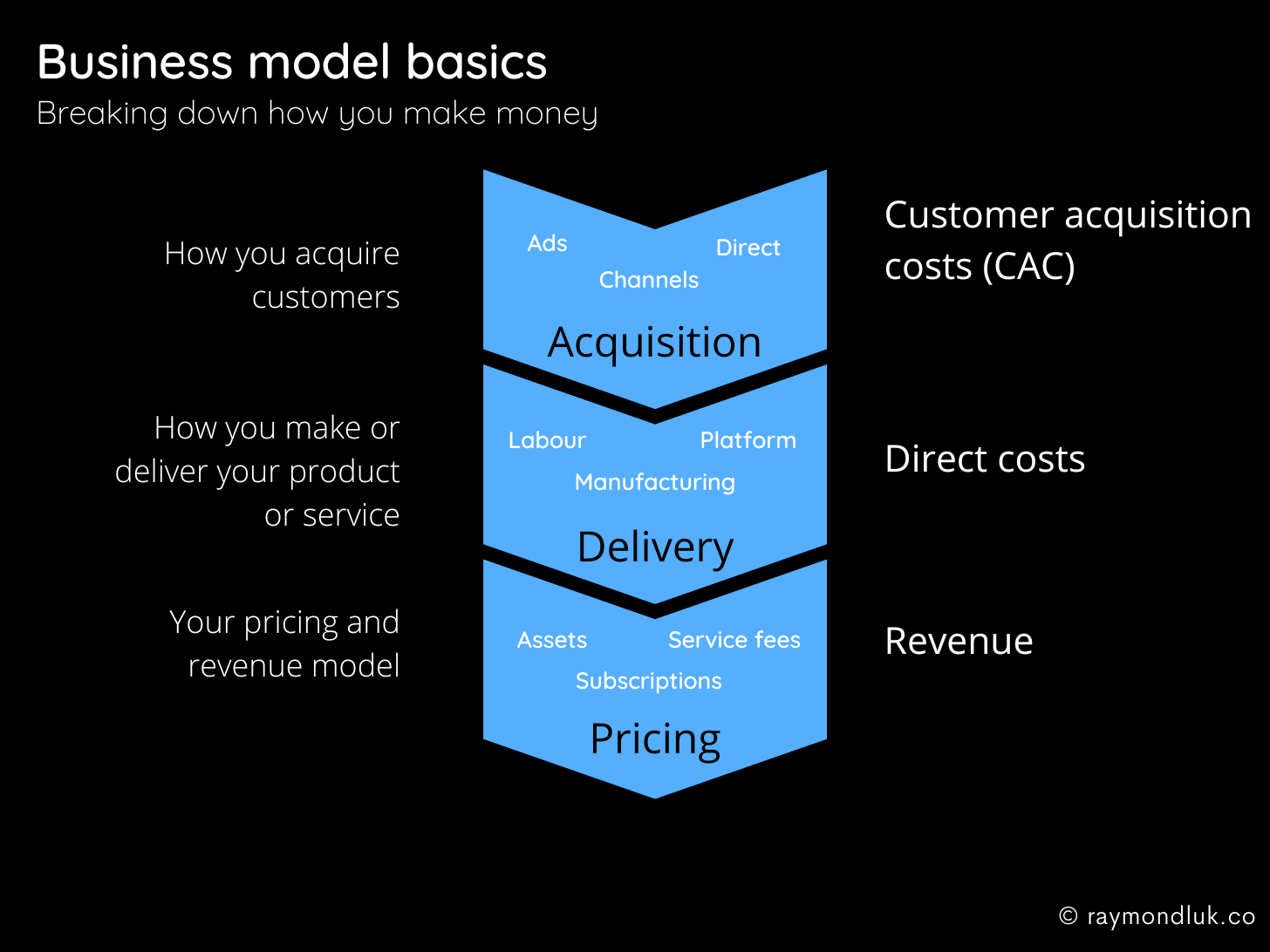

No matter how you design your business model, it should include three core pieces: how you acquire customers, how you make or deliver your offering, and how you will price it.

Acquisition

Incredibly, many pitch decks never address the costs of acquiring a customer. These could include marketing and brand building, advertising, a direct salesforce or everything you do to build and nurture channels. You only need to focus on your primary acquisition costs. Roughly speaking, these costs divided by the number of customers equals your customer acquisition costs (CAC).

Delivery

Whether you manufacture a product, build software or run a consulting service, there are the direct costs associated with delivering your offering. These costs divided by the number of products (or hours of service) delivered, equals your unit costs. There are many ways to calculate unit costs. For your slide just make sure you don’t underestimate.

For some products, especially physical goods, you will need to make an assumption about the volume you need to achieve these costs. E.g. once we produce 5,000 units it will cost $2/unit.

Pricing

Price, and your revenue model, are obviously major factors in making money. You might sell physical goods (i.e. assets) to your customers, have a monthly subscription or charge an hourly rate. The actual revenue you earn per customer is less than your sticker price due to things like spoilage or returns, discounts and churn.

You can go into more detail and quantify your unit economics or your CAC:LTV ratio. Keep focused on the big picture: your business model story should show that what you charge is greater than all the costs associated with selling one unit of your product or service.

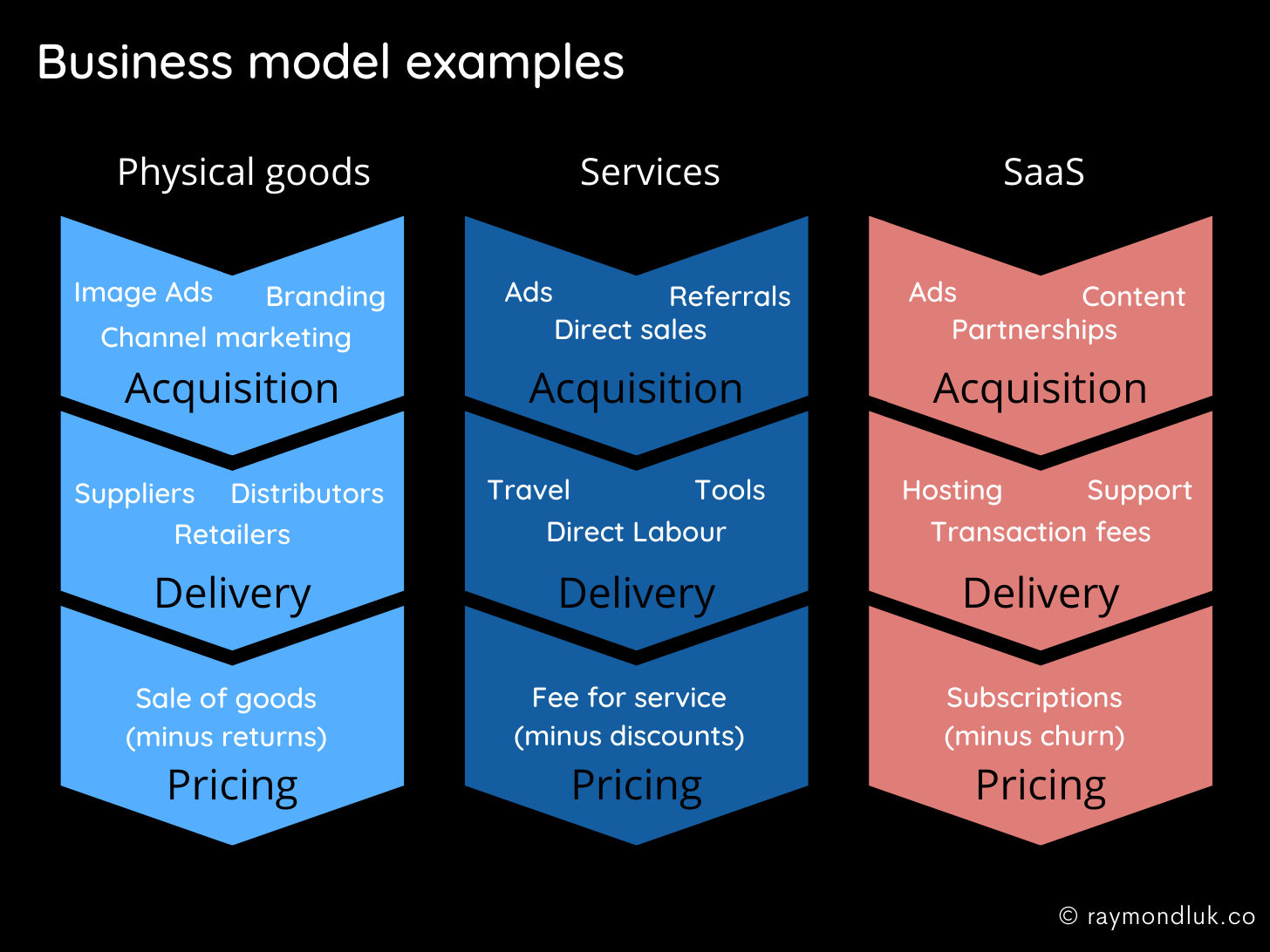

Examples: physical goods, services, SaaS

Here’s how I would talk about the business model for three different types of businesses:

Physical goods

You will need to talk about your supply chain, i.e. vendors, manufacturing, distribution and retail (unless you are DTC). You should be explicit if you are building your own brand, which has costs, or selling through retailers, which also has costs. What might negatively affect your revenues are things like defective products or returns. Your story could be about locking up a low-cost manufacturer or building a brand that cuts out retailers.

Service businesses

The main direct cost of a service business is the labour to deliver the service, whether you’re mowing lawns or providing strategic consulting. Some service businesses have non-negligible costs like travel. Most consulting businesses will have discounts or write-downs that affect revenue. Acquiring customers may be simple word-of-mouth or having to staff a direct sales force. Your story could be about keeping your consultants busy (low idle time) or using paid referrals to reduce acquisition costs.

Software-as-a-Service (SaaS)

There are many resources out there that break down SaaS business models and you should expect savvy investors to be knowledgeable about them. Do not make the mistake of under-explaining how you acquire users because it’s usually costly. It’s your job to know exactly how much. When you estimate average revenue per user (ARPU) make sure you factor in churn, i.e. losing customers. Your story should be precise about acquisition costs and take into account what your competitors pay to acquire a new customer.

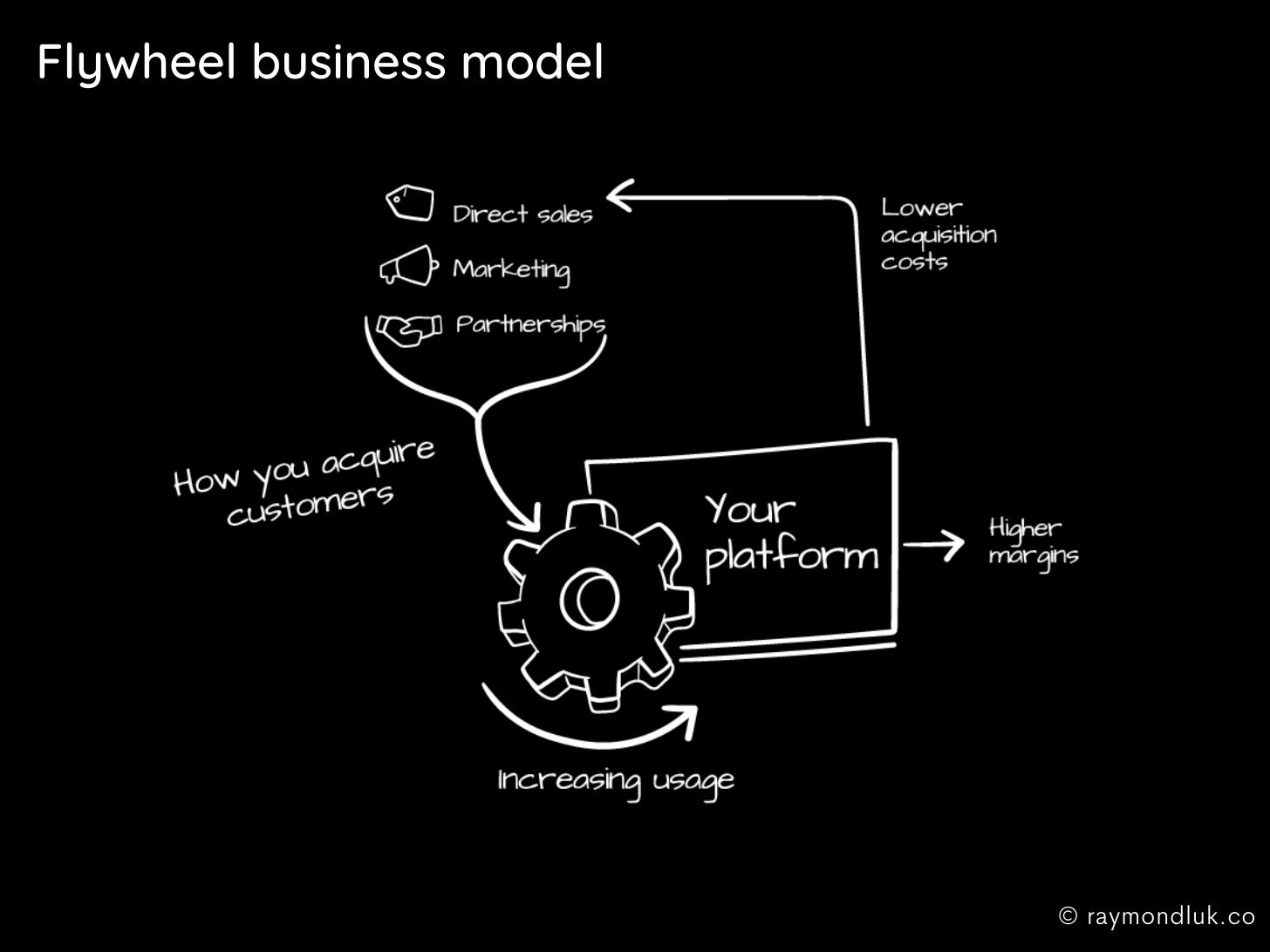

An idealized business model: the flywheel

The ideal business model is a flywheel, i.e. where the different parts of the system work together efficiently to increase revenue and drive down costs. Not every business needs to be a flywheel and investors need an occasional reminder that a flywheel is not a perpetual motion machine.

In this example, more usage of the platform means higher margins. That could be through economies of scale, network effects or the benefits of user-generated content. Some of that increased usage also brings down acquisition costs. That could be through viral marketing or being able to sign bigger partnerships when you scale. Or simply re-investing your margins in marketing, creating a virtuous loop.

The important is to explain any flywheel effects in your business and how they will benefit you. Here are some additional examples:

- having enough data to train a neural network

- having enough density in your marketplace to effectively matchmake

- being the market leader (Amazon) and selling byproducts (cloud infrastructure)

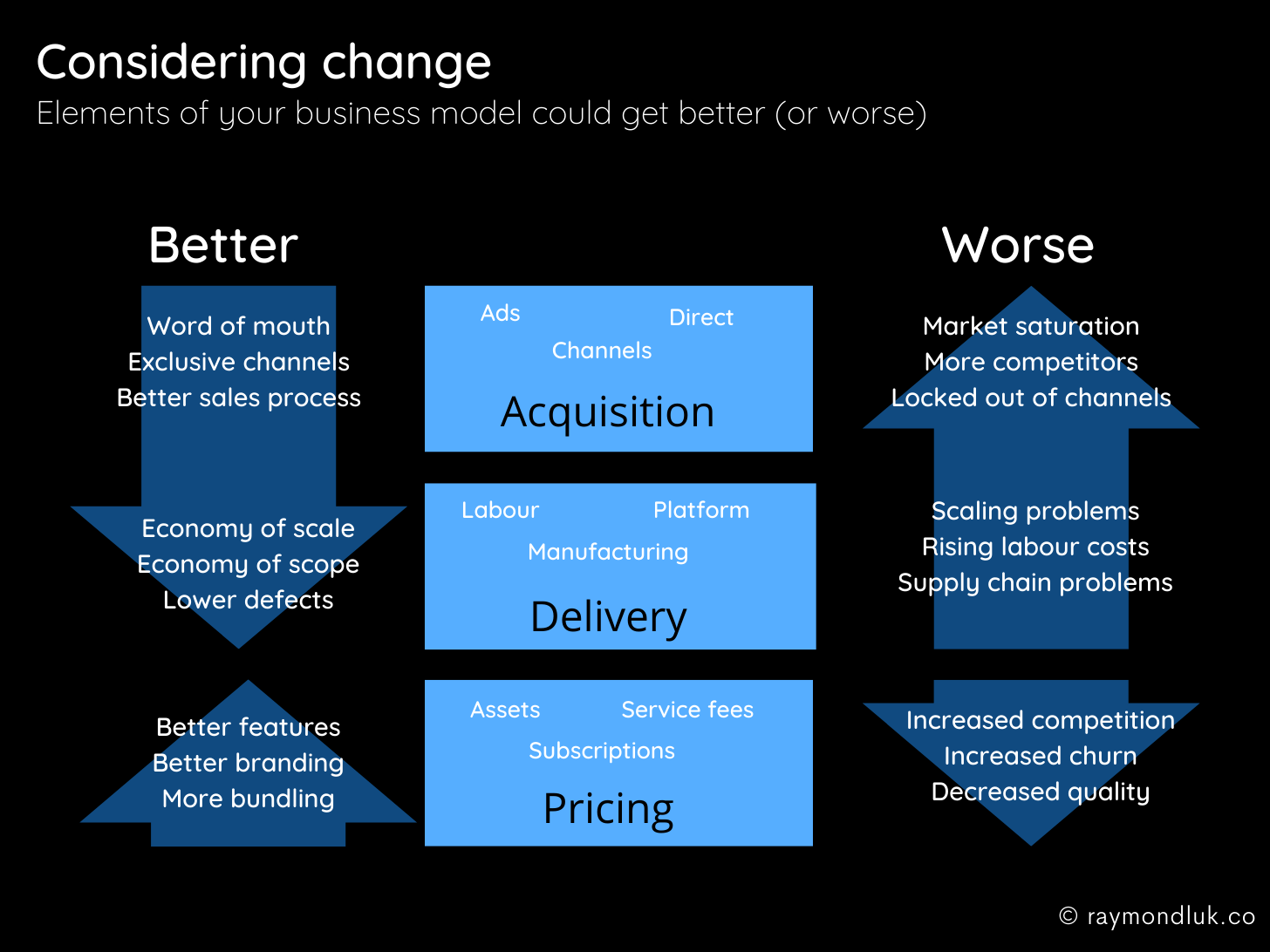

What could go wrong?

The best business model stories consider change. It’s great to talk about positive flywheel effects but you should be prepared to talk about what can go wrong.

Higher acquisition costs

While things like word of mouth can drive acquisition costs down, more competition for scarce suppliers can drive costs up. Locking up exclusive channels can lower (or freeze) costs, but a competitor locking you out can have the opposite effect.

Higher delivery costs

As you scale, economies of scale and scope should bring costs down. As quality increases, defects could decrease meaning fewer returns. But almost all startups have problems scaling, which means costs can just as easily rise. Does your business model factor in fixing bugs or supply chain disruptions? Or if you’re a consulting business could you have rising labour costs?

Falling pricing

With better features and a more valuable brand you might be able to increase your price and your revenue over time. You could integrate with 3rd party products and take a cut of their revenue. But competition could also force you to lower your price (e.g. a price war) or your customers could decide that you aren’t the highest quality offering on the market so they won’t pay your premium price.

No one wants to add gloom and doom to their pitch deck but be balanced in how you talk about the future. Recognize that bad things can happen and be able to explain what you’ll do. That’s the best way to convince an investor you know how to make money.

Summary

Telling a business model story reduces fear and increases greed, in both you and your investors. Having just a few precise numbers about things like acquisition costs and supply chain reduces the fear that you are naive about what it costs to build your business. Then your story becomes about how much money your business can make. Greed is good.