Welcome to Teardown Fridays. These are the final three slides in the self-teardown of the Good Neighbors pitch deck. Start at the beginning if you missed it.

Traction

I made Good Neighbors a seed stage (or pre-seed, whatever) company on purpose. It’s hard to know how to talk about traction when you don’t have any. But in my post about traction I examine the real meaning of traction: grip. I need to show that something is starting to work, and the more difficult or unexpected the better.

Thanks for reading A Leap of Faith! Subscribe for free to receive new posts and support my work.

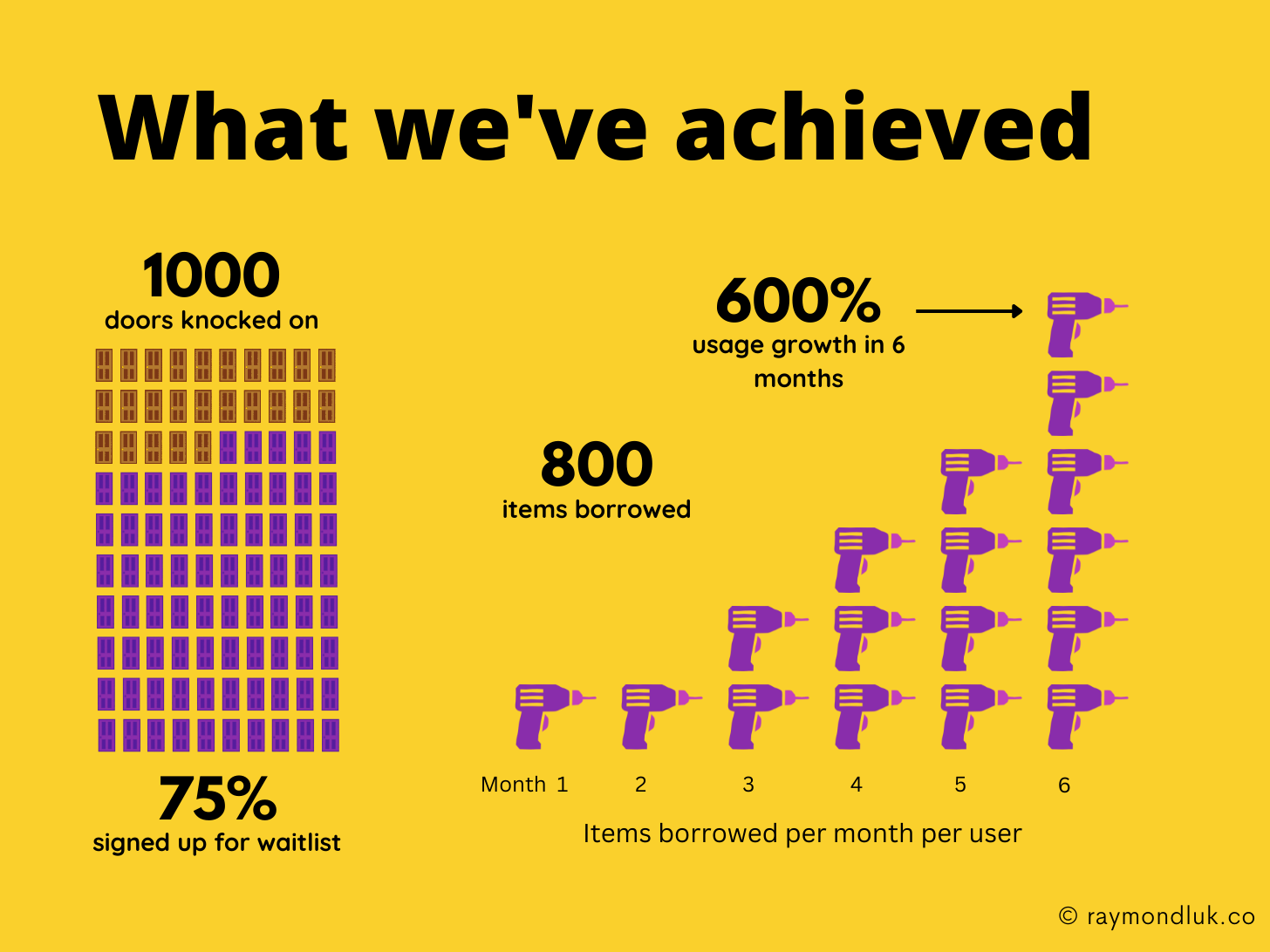

When we were deciding whether this startup was a good idea my (fictional) co-founders and I went door to door. This shows good hustle on our part and a dedication to customer development. But the fact that 75% signed up for the waitlist is an unexpectedly strong signal of demand for our product. That’s good traction.

In the six months since running our MVP one thing that stood out was the growth in the average number of items borrowed every month by a user. Even if it’s a small number of items right now, a 6x usage growth is a fantastic metric. It probably leads to lots of interesting discussions about the types of things being borrowed, what other things are similar, the effect of seasonality etc.

As an early stage startup I want my traction slide to show something is working, but also to points to many other ways we could grow. It’s a conversation starter.

Financials

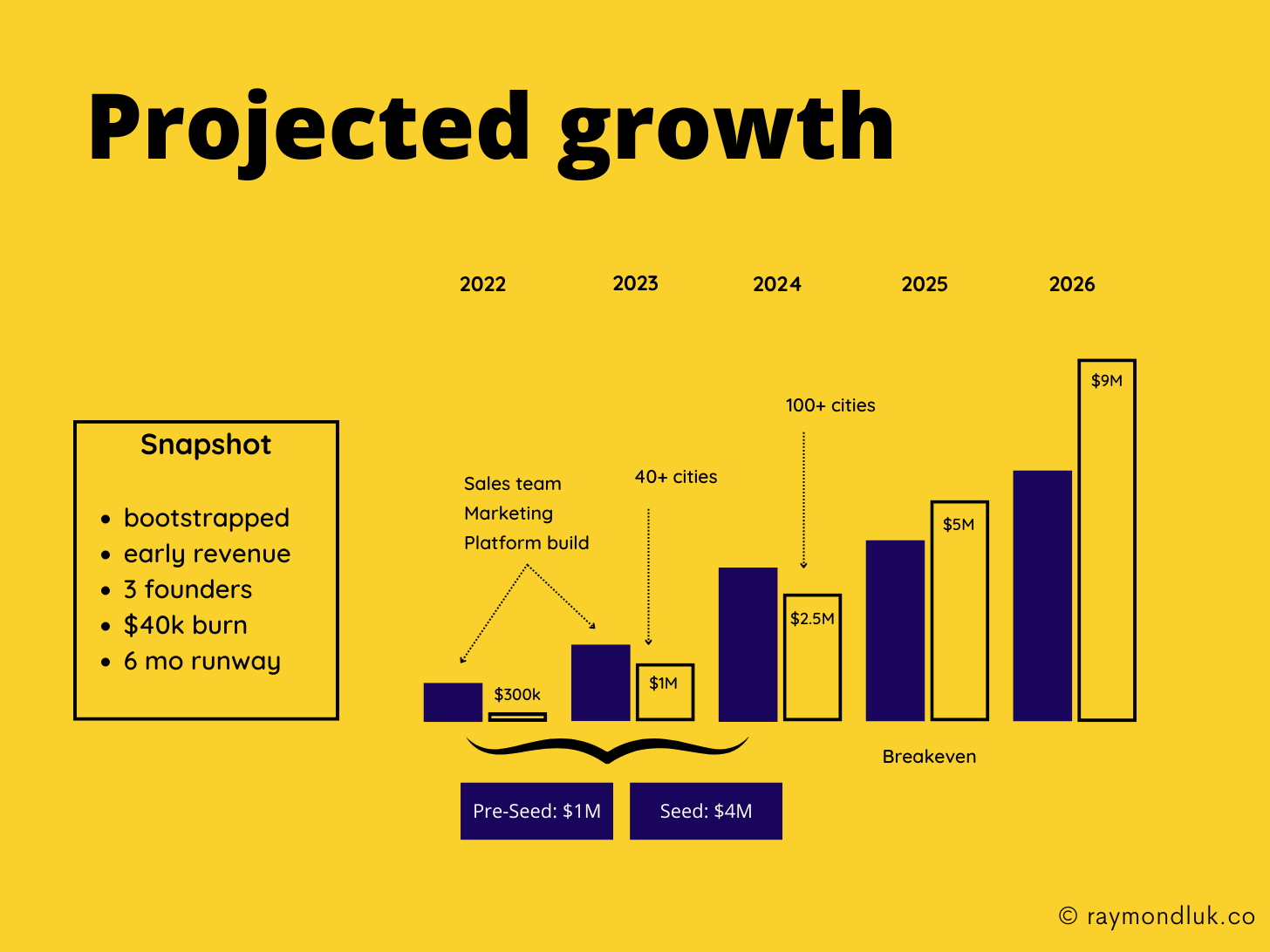

Even though we have very little revenue yet, I still wanted to show our overall financial plan. It’s true that I don’t actually know if this plan will come true. But I need to show some of my assumptions including how big I think this can be in five years.

I chose a simple format that shows top-line revenue growth as the main metric. You’ll notice my expenditures aren’t even labelled. It’s not because I’m hiding the numbers. But at this stage only the high-level matters; things like when you breakeven and roughly how much are you going to spend.

I added some useful notes like what we’re spending our money on in the short term. That synchs up with our use of proceeds on our Ask slide. I also pointed out the number of cities we think we’ll hit. This should match our GTM and gives investors a clear idea of what the next milestone is.

For fundraising I’m anticipating raising $5M in two rounds to get to breakeven. We’ll probably raise more capital (if we’re successful) but it’s not necessary to go into that much detail right now.

Finally, my little snapshot answers key questions about my past and where am I currently.

Ask

This is a very straightforward slide: we’re raising $1M and I broke out roughly how we will spend it. The most important thing is to say what I think Good Neighbors can achieve with this capital.

I considered adding a high-level cap table but at the pre-seed stage the assumption will be that it includes the founders only. If I already had commitments in the round I would include that or mention it verbally.

The last thing I’ll do on my pitch deck is add the ask to the title page so investors know what I want right off the bat.

Thanks for reading A Leap of Faith! Subscribe for free to receive new posts and support my work.