This is a continuation of my teardown of a fictional pitch deck I created, I guess you’d call it a self-teardown. The (fictional) startup is called Good Neighbors. Read part one (Problem, Solution, Product), two (Market) and three (Competition).

Subscribe to my newsletter for weekly posts about pitching and founder storytelling.

Here’s the Good Neighbors strategy to make money:

- Get a few key people in a neighborhood to start lending their stuff and inviting others to borrow.

- Use word-of-mouth and viral loops to acquire other neighbors organically.

- Grow revenue/profit by adding complimentary services.

In an actual pitch I can talk about how we’re going to use direct sales to find those initial users (don’t be a skeptic until you read Lenny’s excellent article proving this is what Uber, DoorDash etc. did). I could dive into product features like suggesting lenders become borrowers and vice versa.

But for the Business Model slide you want to stay fairly high level. Showing your strategy and how it works is more important than a screenful of numbers. Here are two examples.

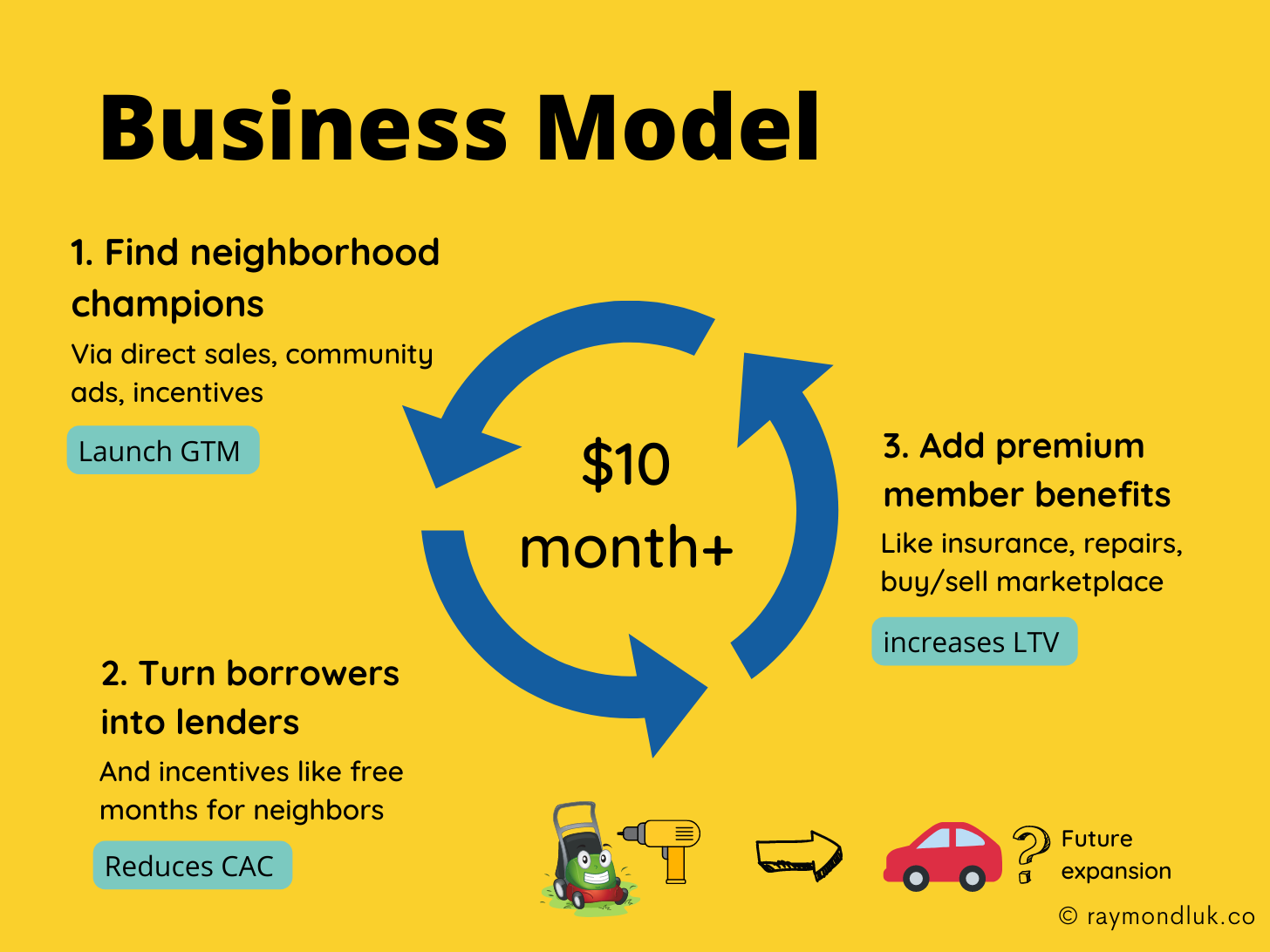

Version 1: Focus on story

This version emphasizes story over numbers. It has only one number: $10/month. Instead, it talks about the three main components of the business model. The circle graphic shows a virtuous loop of attracting users and creating more value. It also suggests that this approach will be done in each neighborhood we expand to.

I added callouts: “Launch GTM”, “Reduces CAC” and “Increases LTV”. These highlight things I want to draw attention to, e.g. how viral loops reduce CAC. There are numbers behind those but I’m choosing not to show them.

Finally, the little pictures at the bottom paint a picture where we expand to lending/borrowing other things including cars. It’s a teaser, but one that says “but wait, there’s more.”

Negatives

This is for a seed stage company with early traction, not for a company with more users. In that case the expectation would be to see more specific metrics, i.e. what’s actually working and what’s the trend.

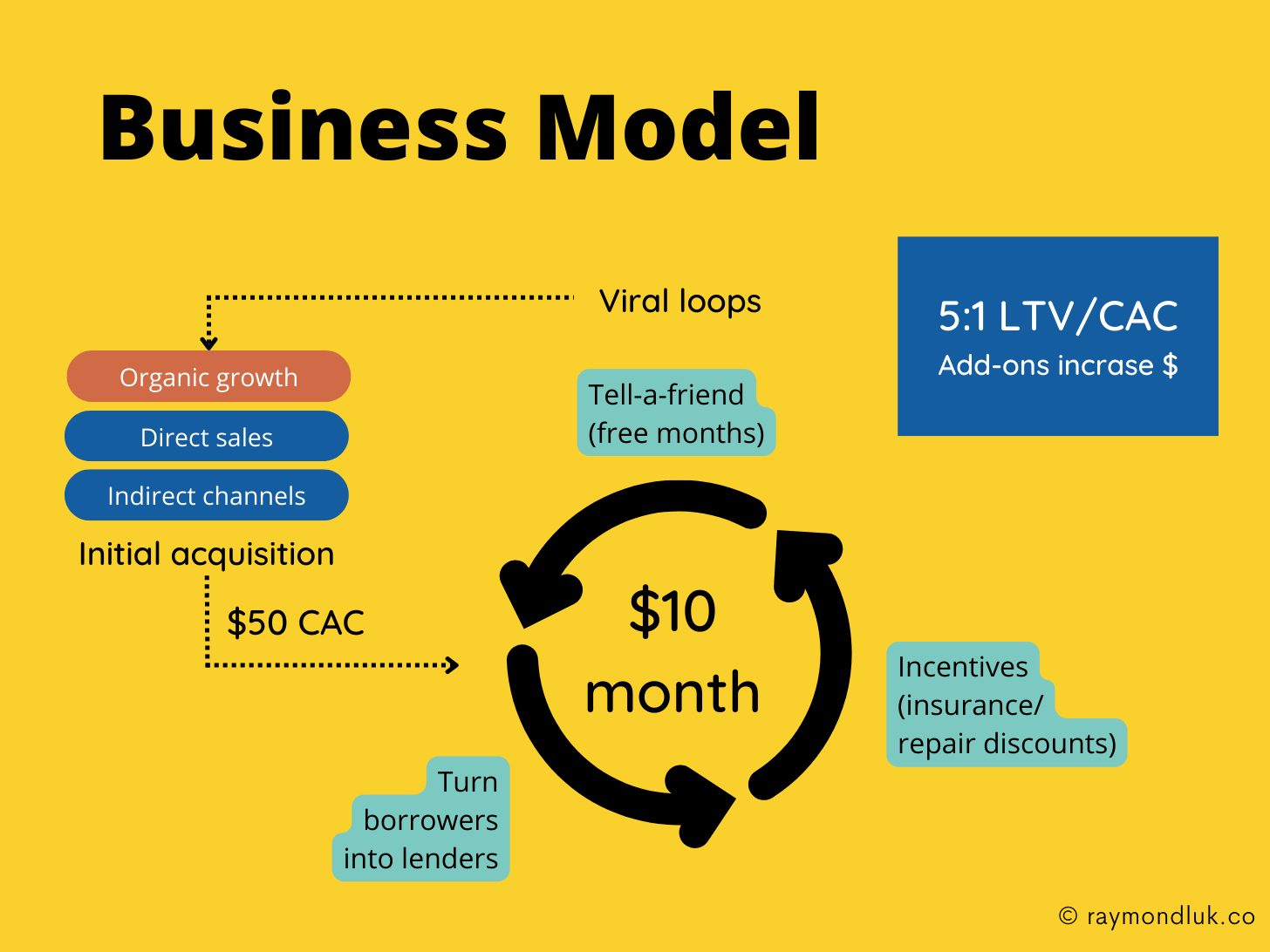

Version 2: Focus on details

This is a different take on our business model slide, one that gets into more detail and introduces more numbers. I wouldn’t add any more complexity than this but it does show more sophistication in our model. It’s not a hope and a prayer, it’s a plan.

By breaking out acquisition channels (organic, direct, indirect) we are signalling that we know the numbers behind those and are happy to talk about it. E.g. we know that opening up a neighborhood will be expensive (postering, door knocking, phone calls, mailers) but it’s a conscious choice.

We expect that up-front money to kick start the viral loop. After that the product takes over by incentivizing people to join, become more active, and telling their neighbors.

Because we don’t charge a fee per rental, our lifetime value is about getting enough value to keep users paying $10/month. In this example I’m assuming a 3-year average lifespan minus 20% churn (60 months X $10 = $600, minus 20% churn = $480 or roughly 5:1 LTV/CAC).

The main advantage of showing a few more details is being able to talk about aspects of the model we’re excited about. Presumably, we learned some interesting things from our MVP and customer development (right?). Those insights can be on this slide.

Negatives

This is still an early-stage business model and it’s still light on numbers for a more mature product. There’s a big missing discussion about how the $50 CAC is an average of the (higher) cost to acquire the first few champions and users acquired organically. I didn’t include that because it’s getting in the weeds, but I wouldn’t expect a VC to accept $50 at face value.