Investors: you need to stop asking founders for financial projections.

Founders: you need to start doing financial projections.

I believe in both and I’ll explain why in this post.

Thanks for reading A Leap of Faith. Subscribe for articles on pitching, funding and founder storytelling.

How useful are projections?

Kirsty Nathoo from Y Combinator say sophisticated investors never ask about projections at the seed stage. If they do, she says, they’re not sophisticated investors…

“If you’re being asked those kinds of questions from investors… it probably means those investors are not actually that experienced at investing in early stage companies.”

This kind of makes sense. Building a great product > building a great spreadsheet based on wild assumptions.

But other investors believe you should never invest in a company that refuses to talk about their financial future. By the way, those people believe they are sophisticated.

This also makes sense because some people don’t like hearing this:

“You give me the money. I’ll spend it. What could possibly go wrong?”

I don’t think creating projections in Excel is an indicator of how good an entrepreneur is.

But I do believe there’s a way to work through projections that is useful to founders themselves, not just to show off to investors.

Why founders hate doing projections

- founders don’t actually know the future

- everything is an assumption and those assumptions will change

- some early stage startups raise money without any projections

Did I miss anything?

Going from zero to one is an incredibly difficult stage. There is maximum uncertainty, maximum change, but minimum room for error. Eg:

- You don’t know how long it will take to achieve product-market fit (it usually takes longer).

- You don’t know how many people you need to achieve your next milestone (most founders hire too many, not too few).

- Once you start growing, that growth could be slow, fast, exponential (or short-lived).

You can’t avoid those uncertainties but you can create a narrative that gives you direction and some guardrails for your journey. Being able to talk about a financial plan tells investors you aren’t going to make the obvious mistakes.

Review of current advice

A wrong starting point.

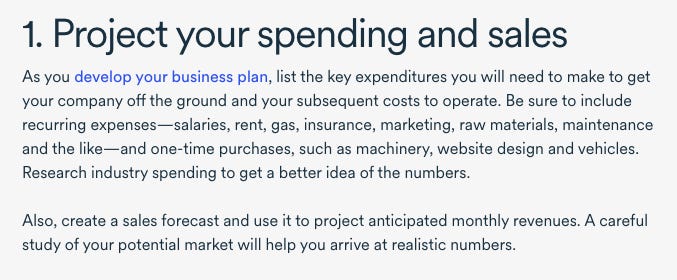

Almost all advice on financial projections starts with the assumption that you can project your sales and expenses.

That is not the starting point for early stage founders. Here are two examples:

Projecting sales: The one thing you have absolutely no idea about is your future sales. It makes no sense to start filling in sales numbers as the first input to your financial model. What you think you can sell should be the end of a planning process, not the beginning.

Projecting expenses - You’d think it was easy to project expenses, but it’s not. For tech or services businesses the biggest expense is people. But most startups do not have a clear understanding of the headcount they need. They often overestimate. For B2B businesses it’s too easy to input sales salaries with no idea about the conversion rate.

Overall, any advice that says, “first, enter your sales numbers” is not useful for early stage startups.

The dangers of market research.

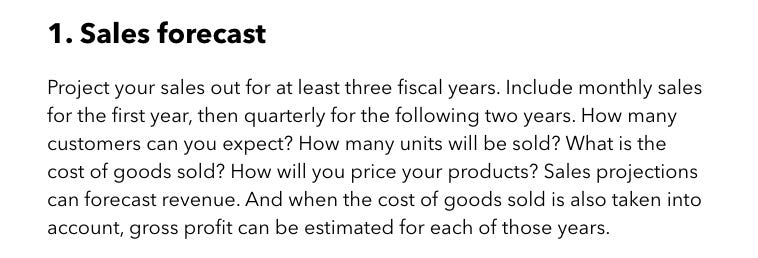

Another reasonable, but wrong, approach is to say that founders should create a financial model based on market research. Here’s an example:

The problem is, in startups there’s usually very little market data because you are (or claiming to be) creating a new market. The same applies if you’re targeting an overlooked market or inventing a new behavior.

If it’s so new where will the market data come from?

Financial projections based on market research lead to a false sense of security. It doesn’t matter what the standards are if your strategy is to disrupt those standards.

It can also be misleading to look at what another startup has done, or even standard metrics like SaaS metrics. If you really dig into the numbers you’ll find they are for different companies, different industries, different times and different people.

Not so standard after all.

You need to develop your own opinion on your numbers.

So. Many. Templates.

There are way too many templates out there claiming to help startups do projections.

If you are a founder without a strong financial background, templates are a tempting shortcut. Enter some numbers and everything updates for you.

But templates often put you into the mindset of filling in the blanks instead of considering the actual huge swings and big changes that are likely in your future.

Most templates do not recognize the type of change that startups experience.

They focus on easy stuff like creating balance sheets and income statements. That’s not a problem that founders need to solve. Any competent CFO or accountant can do that.

I haven’t found a template that addresses how to create a model from scratch for true early stage startups.

At last, some good advice.

But one of the better resources I found is ProjectionHub, a company that offers a library of financial projection templates.

Their Ultimate Guide to Startup Financial Projections was one of the few that advised against just saying “project your sales.” The article goes into detail about different approaches startups can use, eg:

- Capacity based - where projections are based on internal limitations like manufacturing capacity, billable hours etc. Obviously startups can’t assume they will have enough demand to fill their capacity. But it’s at least useful as a smell test.

- Funnel-based - based on some assumption of how your funnel would convert, eg based on CTR of ads. There are some good examples of how you might do this for a sales team, ad budget, downloads etc.

I haven’t used ProjectionHub myself and I’m not affiliated with them in any way. But I did reach out to the founder, Adam Hoeksema, to get his perspective as he’s seen a lot of startup financial projections.

What is the biggest mistake startups make when they do projections?

The most common issue I see is when the founder simply projects a customer count or revenue number without any meaningful, data-driven assumptions to back up how they got there. It is common to see projections that say something like 1,000 customers in year 1, then 3,000 customers in year 2, and 5,000 customers in year 3. But we don't see any assumptions for how the business will acquire those customers. A better approach would be to start with an ad budget, estimate a cost per click which you can back up with data from Google Keyword Planner Tool, estimate a conversion rate of website visitors to customers that align with typical conversions in your industry, and use that to forecast customer counts and ultimately revenue.

What’s the most useful thing a startup can do when they do projections?

I like to recommend using Google Keyword Planner Tool to estimate the search traffic volume for relevant keywords and the cost per click for those keywords in order to get some understanding of how many people might be looking for your solution and how much it will cost to advertise to those leads. I also recommend using a tool like Ahrefs.com which allows you to get an estimate of organic traffic to your competitor's websites. So for example, if your competitor is getting 20,000 organic visits per month and they are currently best in class and have been operating for 5 years, you can safely assume that your business won't start out with 40,000 organic visits per month on month 1. Both of these tools provide some guardrails to help you make reasonable assumptions about how many potential customers you have and what it might cost to acquire them.

Getting Granular.

Another good article I found is called Granular Financial Forecasting by Sean Lim.

For founders with a deeper financial background, Sean Lim’s article is a strong rebuttal to “there’s no way I can do projections at the early stage.”

He goes into detail about different techniques using simple visualizations to explain how each projection can be done. It’s easy enough for a non-financial person to understand, but still requires founders to think through their assumptions. Some of the approaches covered include:

- Direct sales conversions

- Lead generation through marketing channels

- Organic sales, eg SEO and word of mouth

He also goes into detail about ways to forecast cost of goods sold and customer lifetime value (LTV).

Tools?

I have yet to come across a tool that helps founders understand and plan their financial projections from a cold start. Like templates, existing tools focus on generating slick spreadsheets and dashboards once you have the numbers. But you don’t have those numbers yet.

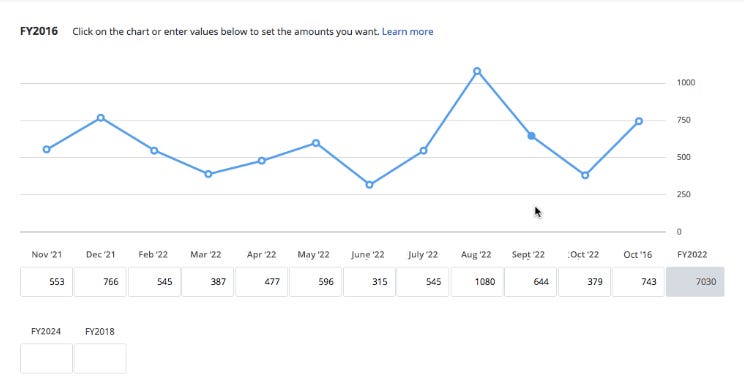

Liveplan, for example, has what they call “drag and drop financial forecasting.” It looks slick as a UI but the problem isn’t that it’s difficult to type numbers into a cell, it’s that you don’t know what numbers to enter (or drag to).

PlanGuru has powerful financial forecasting tools but it’s more geared towards building projections based on companies with an operating history. Not for startups who haven’t launched their product yet.

What’s missing

In summary, I think most investors do not want founders to be totally clueless about finance, no matter what they say. But we don’t need to help founders fill in the blanks on yet another spreadsheet, or teach them how to prep financial statements.

We should focus on creating something that captures big, hairy startup changes. So they plan for those changes. And avoid running out of money.

Enough of being a critic. Next post I’ll share my new approach to projections, and a simple tool.