This is part 9 of a series that walks through the slides in a pitch deck. See Start With the Problem, and Your Startup’s DNA: The Solution Slide, How Not to Waste Your Product Slide, Why Now: Change is the Key to your Pitch, The Market Size Dilemma, How Not to Lie To Yourself About Competition, Telling the Story of How You Make Money, and You've built a better mousetrap, now you need to go to market.

Startup financial projections are frustrating for everyone. It’s frustrating for entrepreneurs because they don’t really know what will happen in year five. And it’s annoying for investors to see financials skimmed over right before founders ask for a million dollar check.

Many pitch decks, especially at the seed stage, still exclude the financial slide. I can’t really get behind this because I’ve never met an investor who doesn’t ask “how do you make money?” Or “how do I make money?”

The goal of this slide is to talk about key numbers that make this an attractive company to invest in. The financials slide should answer questions like:

- How big can this get?

- When do you breakeven?

- How much do you need to raise?

It also answers another key question: “Does this entrepreneur know how to run a business?”

Key points I cover:

- You need a financial model

- What not to do

- A walkthrough of my template

- Summary

Subscribe for free to receive weekly posts about pitching, a copy of my ebook Pitching a Leap of Faith, and invites to my Pitch Masterclass.

You need a financial model

Someone has to build a financial model in a spreadsheet. That could be you if you’re financially-minded, or outsourced to a financial professional. There’s no getting around this and even if you don’t get a lot of detailed financial questions during your pitch, you will in due diligence.

This post is about crafting the slide, not how to do financial projections. But I have one piece of advice: even if someone else prepares your projections, you have to personally know your key numbers. Every founder has a different level of financial literacy and that’s ok. No one is suggesting you pause your startup to do an MBA.

Ask a finance friend or hire a coach for a few hours to make sure you’re knowledgeable about your numbers. It will be time well spent and give you extra confidence when it comes to talking about finances.

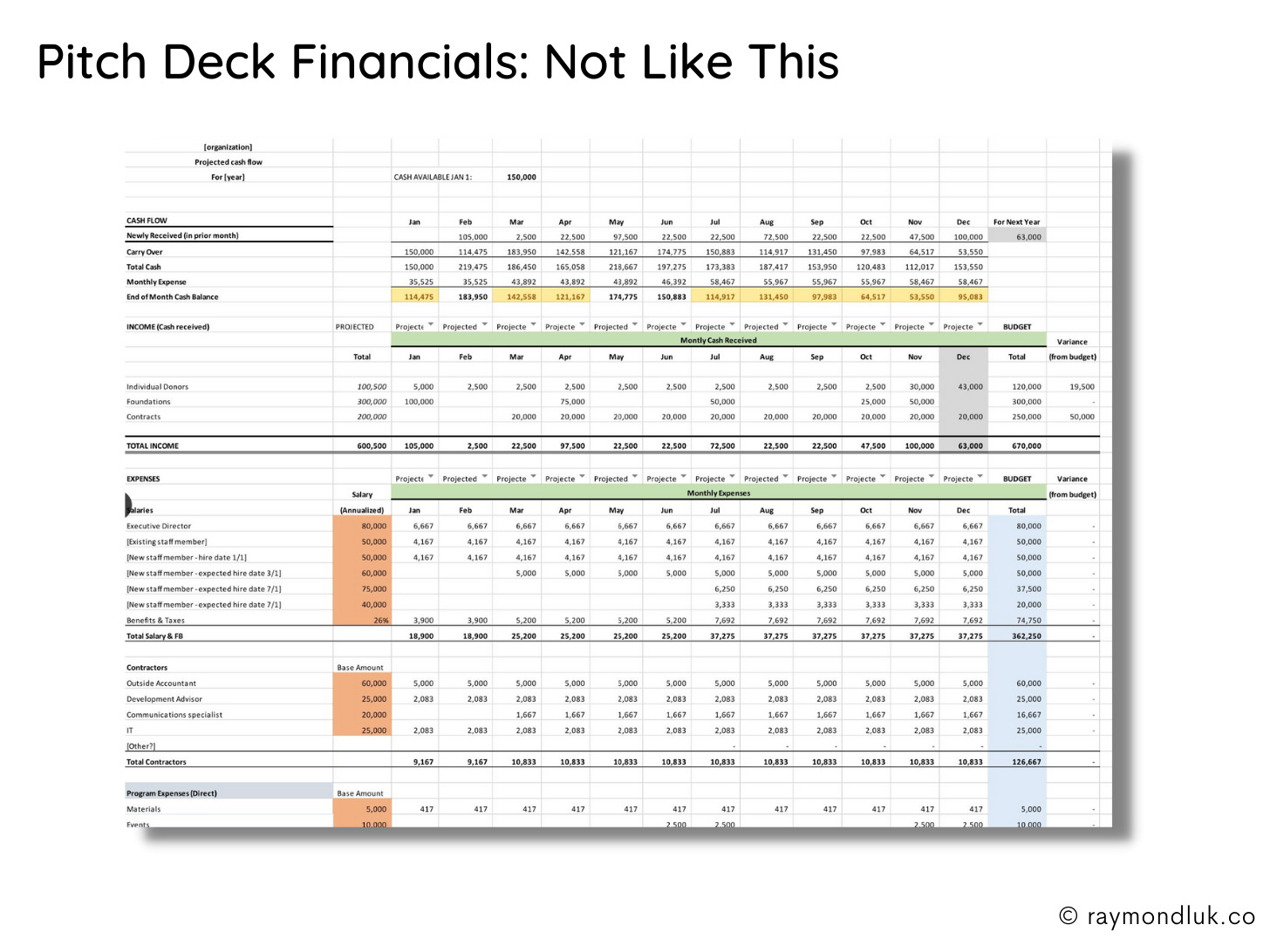

What not to do

There are many ways to design your financial slide, but only one way not to do it:

Copying and pasting your spreadsheet model into a slide says that you think the “numbers side of the business” is best handled by accountants. That’s a big turn off when you’re trying to convince someone you can generate a return on their investment.

It also makes it far too easy to pick one tiny number and fixate on it which will completely throw off your pitch. 95% of the numbers in your financial model do not matter for your financial slide so don’t bother with them. But get the 5% right.

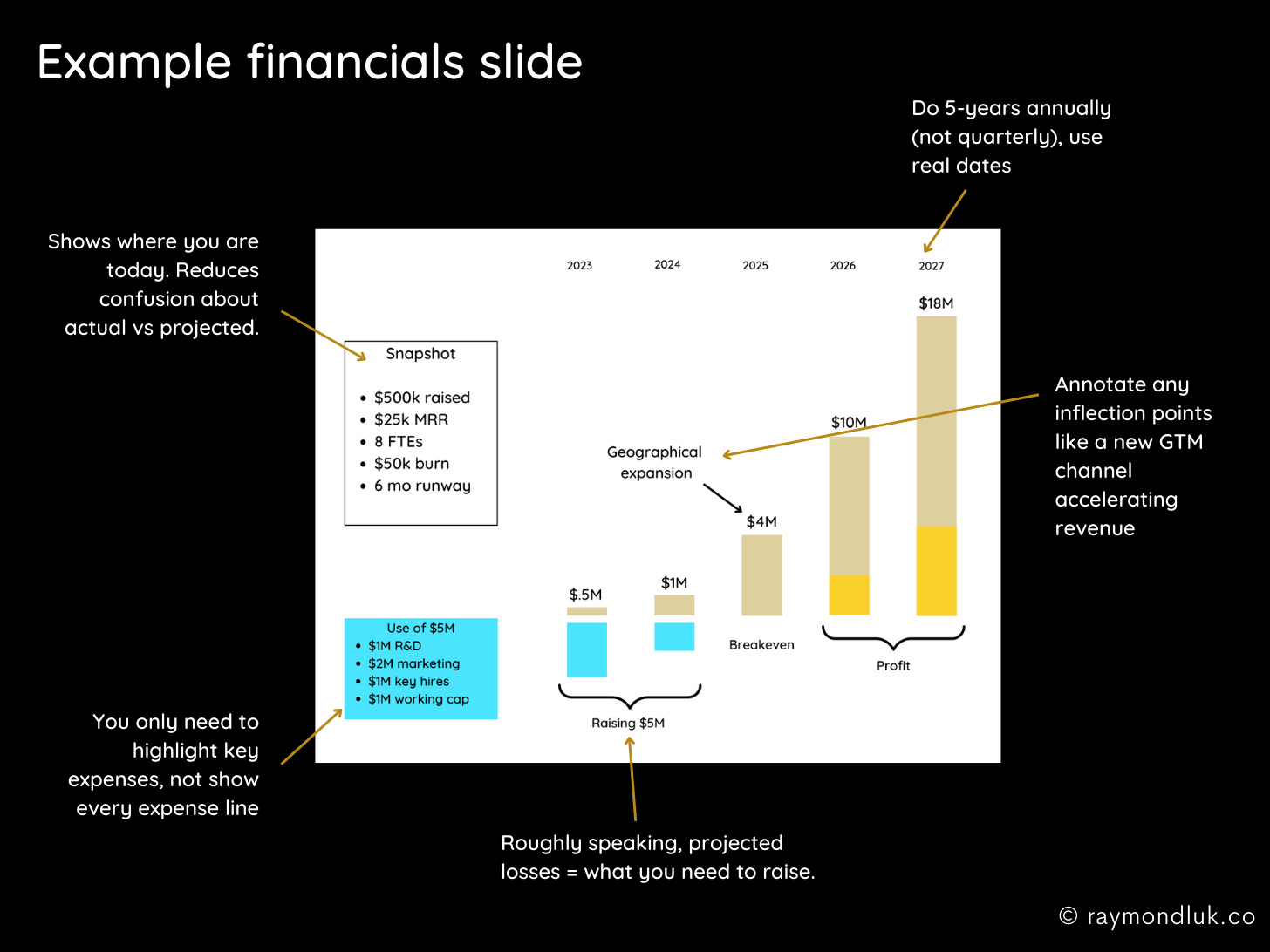

An annotated template

Here is a template I created that balances numbers with storytelling. It’s a simplistic example and I’m not suggested this is perfect for your company. It’s designed to show you an example of telling a numerical story without a screenful of numbers.

By the way, don’t generate your charts in Excel. They might be accurate but you will end up making too many compromises in the design. Have someone design them in a graphics program like Canva (what I used).

Have a snapshot

Put 4-5 bullets in a callout to quickly summarize your results to date including past fundraising. This declutters your chart and removes ambiguity about what’s past vs projected. It’s sometimes not clear if “2022” means actual or projected depending on the date the deck was created.

As a bonus, you can highlight any other traction you want including non-financial numbers.

Do a 5-year projection

Five years is the right time horizon to understand how your startup (eventually) makes money. 3 years is not enough time to show how you achieve scale. Do not do monthly or quarterly projections. It’s too short-term focused and can be dealt with in your spreadsheet (which you did already, right?).

Add annotations

Your chart does not have to be self-explanatory, and often it’s not. Add annotations for key inflection points that you want to talk about. That could be new product launches that affect revenue or expenses, new GTM channels that accelerate sales, or future fundraising needs. It could be FDA approval.

This lets you shine a spotlight on exciting parts of your financials without over complicating the visuals.

You need either expenses or losses, not both

Unless you’re a biotech or deeptech company with no plan for revenue in the first five years, you always need to show revenues. But you don’t need both expenses and profit/loss. In my example I excluded expenses altogether and showed losses. It’s easier to see what I need to raise until I breakeven and looking ahead, it clearly shows when I think I’ll break even.

Use of proceeds

If an investor really wants to geek out about your financial model you can alt-tab over to Excel. Most investors will really want to focus on what you think you can achieve with the funds you want to raise. I recommend adding a callout or comment about key expenses that help you achieve your next milestone.

Summary

Your financial slide is the tip of the iceberg (your spreadsheet is what’s underwater). It’s up to you to decide what you want to highlight in your story.

When you’re creating your slide consider the financial questions you’ll likely be asked:

- What GTM expenses are driving those sales projections?

- Are you underestimating the costs?

- When do you breakeven?

- Will you need to raise more money (and when)?

- What costs fall as you scale?

- Are there any inflection points or milestones that unlock faster growth?

Decide what objection you want to overcome or what exciting numbers you want to highlight and then make sure that’s the focus of your financial slide.