Someone asked me recently about managing a startup during a downturn. I’ve run startups during the dot-com bust and the subprime mortgage crisis, so I guess this is my third downturn. Stick around long enough and you will see proof that what goes up will come down.

Thanks for reading A Leap of Faith, a newsletter about pitching, founder storytelling, and other things.

The Wall

Here’s a story about a startup I was advising in the 2000s. The CEO called me in a panic because they were running out of money. He didn’t see a way out. I went to their office which was in a beautiful loft space in downtown Montreal.

Looking at the bank account and their burn rate I agreed they would be broke in weeks. The CEO asked my advice on how to tell the staff he was shutting down.

“Hold on,” I said. “How much do you need to cut to reach breakeven?”

“50%, but there’s no way to do that,” replied the founder. “Our two biggest expenses are our office and our team, and we need both.” This was 20 years before remote work.

After hours of discussion, I finally looked at him and said:

“We’re going to make two cuts: first we’re going to cut the office in half, right down the middle. Then we’re going to ask everyone to take a 50% pay cut.”

There was stunned silence, followed by a lot of pushback. Then a realization that there was nothing left to lose.

So the CEO gathered his team and explained the situation openly and honestly. He handed out copies of their bank statements so people could see he wasn’t hiding anything. It was a brutal, difficult speech but what happened was surprising.

His team rallied. They embraced the idea of splitting the office. Later I got to see the drywall go up when they found a sub-tenant.

No one on his team wanted to make less money but it turns out they loved this company and wanted to contribute to its survival. This crisis ended up bringing the team closer together and the company ended up surviving the downturn.

They still exist today.

Uncertainty vs certainty.

Startups have unique challenges that are even more intense in a downturn. They are building something new which means the future is always uncertain. They need to spend money but capital is scarce. And they still need to make progress and grow otherwise what survives the bust will not survive the next boom.

Here’s how I think about it:

Reduce uncertainty

In any cycle, but especially a downturn, your future growth is uncertain. You might not grow at all. In many industries, demand will be reduced. I know that any founder worth their salt will claim their product is counter cyclical! It’s even sometimes true.

Reducing uncertainty means reducing your growth projections. Don’t promise the same hockeystick curve.

You can’t throw money at the problem either because that money will be less available.

So plan for lower, slower growth. I know it’s the opposite of startup dogma. Plenty of people will say how the best companies are started in a recession.

That might be true but it will still mean growing slower before you grow fast.

Increase certainty

Revenue just got more uncertain but expenses are frustratingly certain.

Most of us do not have offices to split anymore so salaries are a startup’s biggest fixed expense. Increasing certainty means freezing hiring or cutting salaries. Most well-known tech companies started doing this last year.

It may be a major cultural shift to go from competing for talent to reducing staff and doing more with less.

If you’re lucky and do not have to change your HR strategy, another area to increase certainty is cash flow. Eg:

- Increasing incentives for customers to pay annually vs monthly to get cash sooner and reduce churn.

- Changing the ratio of fixed vs transaction fees so you get paid even if transaction volume falls.

- Being stricter with collections and doing less for free.

Certainty in cash flow means you extend your runway. You never know how long you just need to survive.

But what about growth?

How do you grow as a startup when the business environment is going against you? As the saying goes, “You can’t shrink to greatness.”

The pundits (who previously scoffed at profitability) now say you need growth and strong unit economics and profitability. But there’s little in the way of how to achieve it.

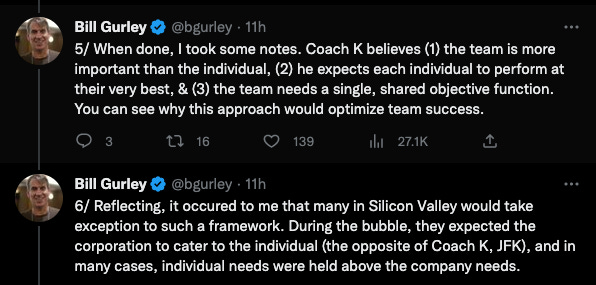

Bill Gurley Tweeted this recently and I think it’s a refreshing take:

The answer to how you shrink and grow at the same time is personal (and team) performance. Obvious right?

But it was only recently that high grow was synonymous with 4-day work weeks, remote work and unlimited time off. It’s now ok to ask your team (and yourself) to be their very best. To hold people accountable for delivering great results and not being afraid to have high standards.

I know everyone will say “we’ve always had high standards!” Good for you, but until you’ve gone through a recession or a downturn you don’t really know what high standards mean.

It means asking high performers to do even better. And holding low performers accountable, quickly. It means asking the seemingly impossible (which is what doing more with less means).

If you read Gurley’s full thread you’ll see he’s brutal with how difficult he thinks things will be even if you are performing at the highest level.

I’m an optimist and I don’t think a downturn means suffering or requires founders to sacrifice their mental health.

But it does mean individual performance is no longer a dirty word. Challenge yourself and your team to be the very best. Like the startup I talked about, you may end up surprising yourself.

Doing less with less to ensure you survive the downturn will make you one of those companies that comes through stronger.